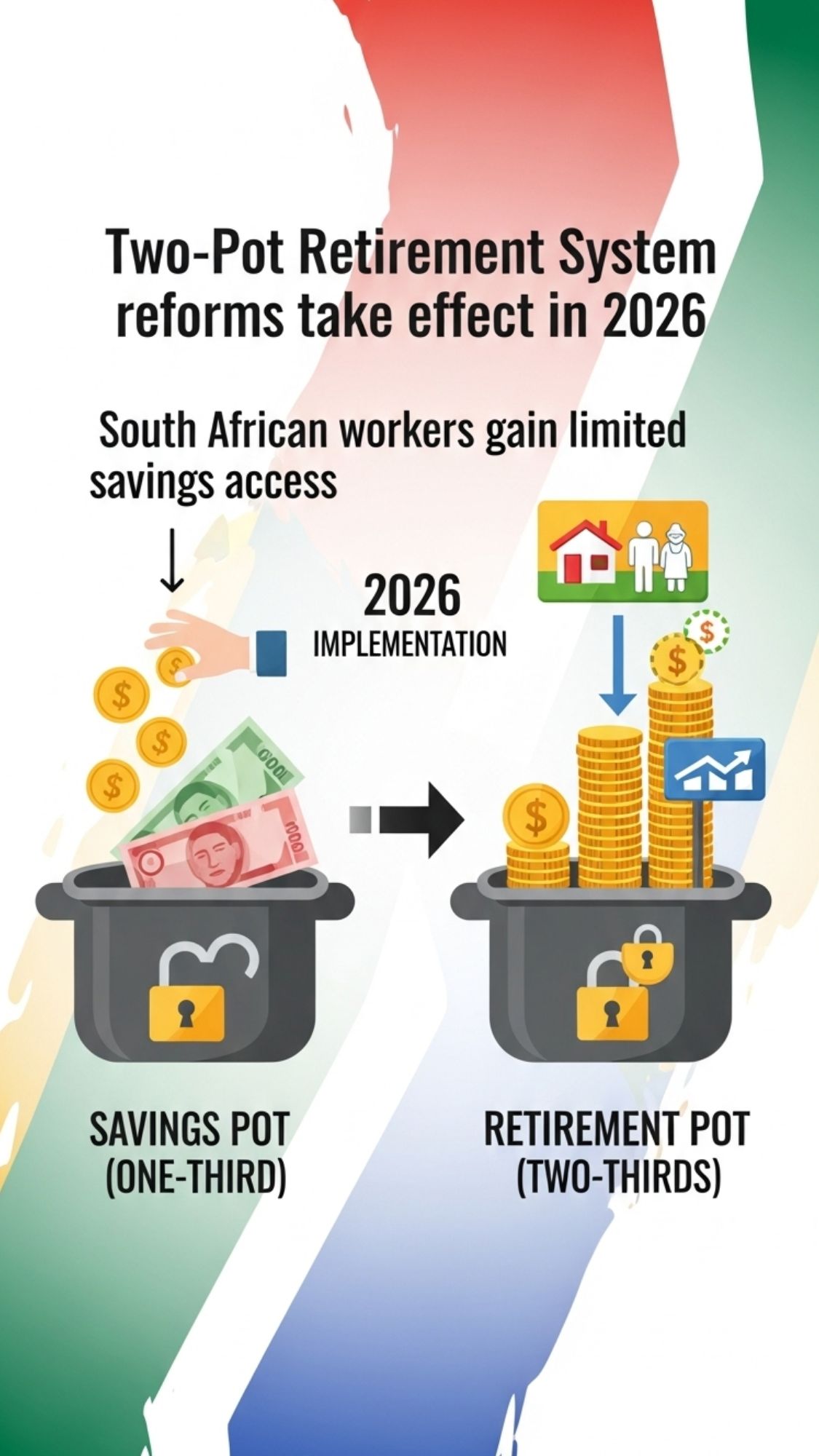

South Africa is getting ready for major changes in how retirement savings work as new reforms start in 2025. These updates will change retirement age rules and how workers put money into pension funds and take it out. The main part of this reform is a two-pot retirement system designed to give people flexibility while also protecting their long-term financial future. Because the economy and population are changing workers across the country should look at their retirement plans now instead of waiting to make sure they have enough money saved.

Two-Pot Reform Timeline and Rule Changes Leading Into 2026

| Age Bracket | Contribution Requirements | Retirement Savings Access Rules |

|---|---|---|

| 55 to 59 years | Regular monthly contributions remain compulsory | Limited withdrawals permitted from the accessible savings portion only |

| 60 to 64 years | Reduced or flexible contribution options apply | Full access to the accessible savings pot, with restricted access to long-term savings |

| 65 years and older | Contributions are optional and no longer mandatory | Unrestricted access to both accessible and long-term retirement savings pots |

| All employees | Enrollment in the two-pot retirement system is compulsory | Emergency withdrawals are strictly limited to the accessible savings pot |

Retirement Age Shifts in 2025 and Their Impact on Workers

The government adjusted the retirement ag

e to extend the sustainability of pension funds. Employees approaching retirement will now contribute to the system for an extended period. This allows them to accumulate additional savings before leaving the workforce. Individuals aged between 55 and 60 will experience these modifications gradually to provide adequate time for financial adjustment. Understanding the updated retirement age is important because it affects your future income levels and the lifestyle you can expect after your working years end.

SASSA Grant Holders Set for January-February Boost: Early Deposits and Bonus Payments Announced

SASSA Grant Holders Set for January-February Boost: Early Deposits and Bonus Payments Announced

Understanding the Two-Pot System and Limited Savings Access

Understanding the Two-Pot Retirement System The two-pot model divides your retirement savings into two distinct sections. One section allows you to withdraw money during emergencies while the other remains locked until you retire. This arrangement helps workers handle unexpected financial difficulties without depleting all their retirement funds. Using the accessible section wisely is important because withdrawing too much money could reduce your retirement income later. Financial advisors recommend creating a careful budget and establishing clear guidelines about when you should make withdrawals. This system provides flexibility when you need it most while safeguarding your long-term financial security.

The key is knowing when to use your emergency funds & when to leave them untouched. Many people find this balance challenging but having firm rules helps prevent hasty decisions that could damage your future. The protected section grows over time and provides the foundation for your retirement years. Meanwhile the accessible section serves as a safety net for genuine emergencies like medical bills or urgent home repairs. Understanding the purpose of each section helps you make better financial choices throughout your working life.

Financial Planning Strategies Workers Should Prepare Before 2026

Workers need to rethink how much they save and where they invest their money due to new age requirements and different savings options. Reviewing retirement documents & setting fresh savings targets can help people align their plans with the updated rules. Getting advice from a financial expert is also useful. Companies have an important job since they must provide workers with accurate information about contribution limits and withdrawal timing under the changed system.