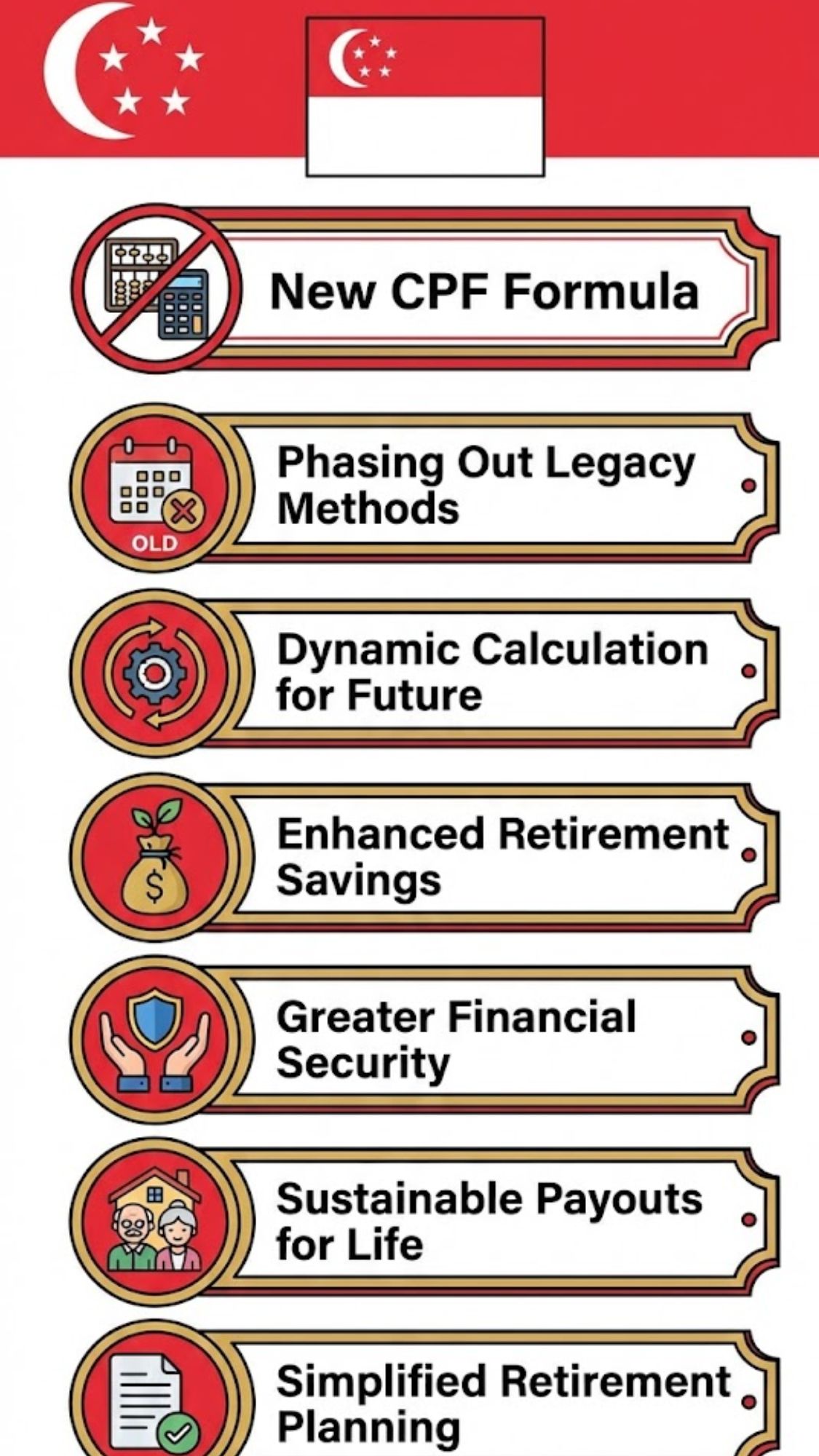

Singapore is reshaping how retirement payouts are calculated, marking a clear shift away from older CPF pension formulas that many workers have relied on for years. The updated approach reflects longer life expectancy, changing work patterns, and the government’s push for more sustainable retirement incomes. For Singapore residents planning their financial future, this change affects how savings grow, how monthly payouts are derived, and how long funds are expected to last. Understanding the revised CPF retirement calculation is now essential for individuals approaching retirement as well as younger workers mapping long-term plans.

Singapore CPF retirement calculation shifts to a new formula

The revised CPF retirement calculation in Singapore focuses on aligning payouts with modern retirement realities. Instead of relying heavily on older assumptions, the formula now factors in longer retirement spans, adjusted payout ratios, and updated contribution logic. This means monthly CPF payouts are structured to provide steadier income over a longer period, rather than higher amounts that risk running out early. The change also considers lifetime income planning, encouraging members to view CPF as a long-term safety net. For many workers, this update improves predictability, even if headline payout figures appear different from older projections.

How the new CPF pension formula affects future retirees

For those nearing retirement, the updated CPF pension formula changes expectations around monthly income. The system now prioritises sustainable monthly payouts over short-term gains, helping retirees manage expenses across decades. Individuals may notice differences in estimated payouts, but the intention is to support financial stability later in life. The formula also supports flexible retirement planning, allowing members to adjust retirement sums and payout start ages. By accounting for evolving demographics, the CPF framework aims to reduce uncertainty and ensure savings last throughout retirement.

Why Singapore updated its CPF retirement payout method

Singapore’s decision to revise the CPF retirement payout method is rooted in demographic and economic shifts. With people living longer and careers becoming less linear, older models were less effective. The updated formula reflects changing workforce trends, rising longevity risks, and future cost pressures. Policymakers want CPF to remain relevant for younger generations while still protecting today’s retirees. By modernising calculations, the system supports balanced retirement outcomes and reinforces confidence in CPF as a cornerstone of Singapore’s social security framework.

Summary and retirement planning outlook

Overall, the CPF retirement formula change represents a shift toward long-term security rather than short-term optimisation. While some individuals may need time to adjust expectations, the focus on income durability, retirement certainty, and forward-looking design offers clear benefits. For Singaporeans, the key takeaway is to review CPF statements regularly and align personal savings with the new calculation approach. With informed planning, the revised system can support a more predictable and resilient retirement journey.

| Aspect | Old Approach | New CPF Formula |

|---|---|---|

| Payout focus | Higher early payouts | Steadier long-term income |

| Longevity consideration | Limited | Fully factored in |

| Planning flexibility | Lower | Greater adjustment options |

| Retirement sustainability | Moderate | Improved resilience |

Frequently Asked Questions (FAQs)

1. Who is affected by the new CPF retirement formula?

It applies mainly to Singapore residents planning retirement under updated CPF rules.

2. Does the new formula reduce monthly CPF payouts?

Not necessarily, as it aims for steadier income over a longer retirement period.

3. Can members still adjust their retirement payout options?

Yes, flexibility remains through choices like payout start age and retirement sums.

4. Should younger workers change their CPF planning now?

Yes, reviewing long-term plans helps align savings with the updated calculation method.