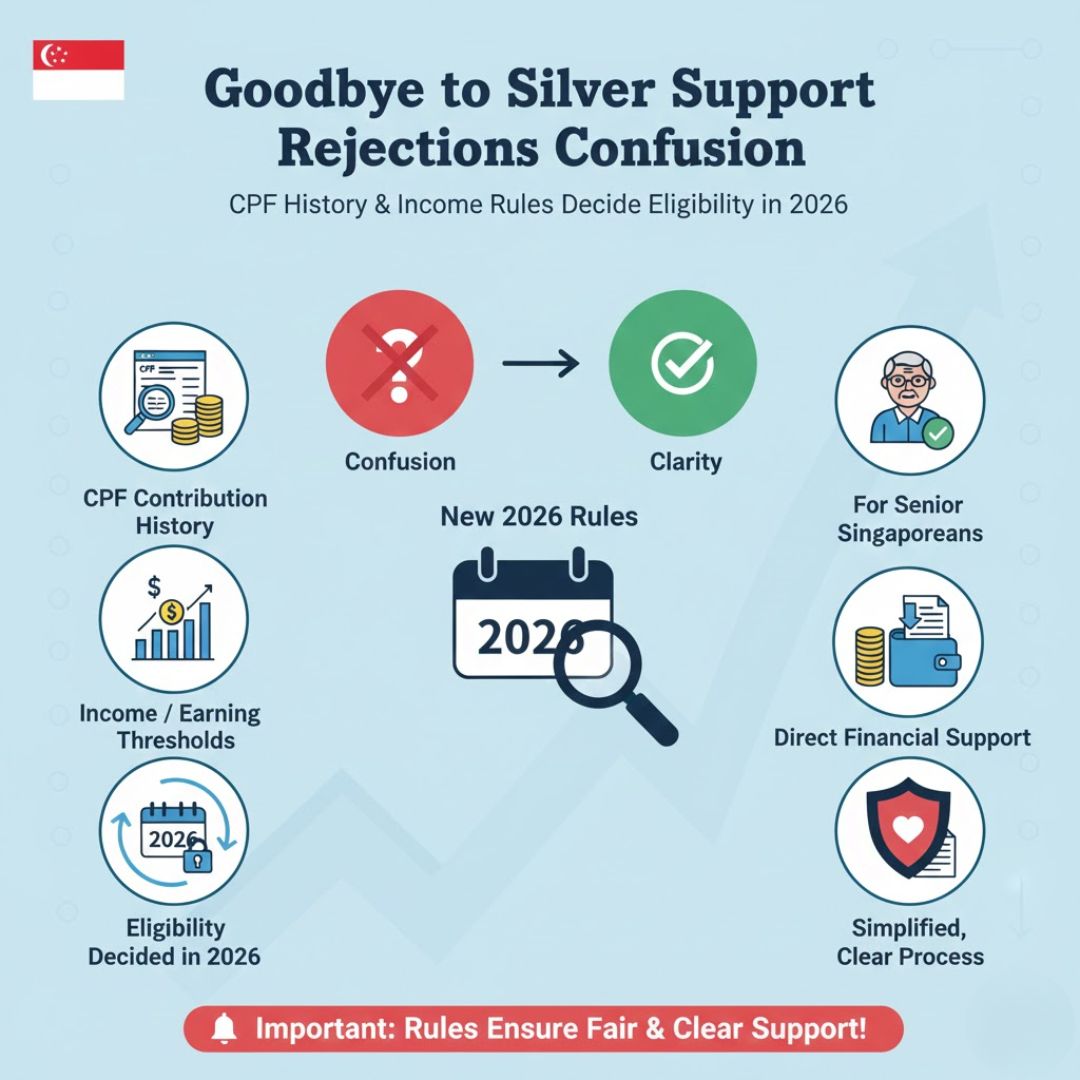

Many seniors in Singapore feel uncertain when their Silver Support applications are rejected, often without fully understanding why. In 2026, eligibility for the Silver Support Scheme is shaped mainly by CPF contribution history and assessed income, rather than simple age alone. These rules aim to ensure that help reaches older residents who had lower earnings over their working lives. By clearly explaining how CPF records and income thresholds work together, this guide helps Singaporean seniors and families move past confusion and better understand what determines approval or rejection.

How Silver Support eligibility rules work in Singapore

Silver Support eligibility in Singapore is designed to focus on seniors who earned less consistently during their working years. Authorities look closely at CPF contribution patterns to assess long-term income adequacy, not just recent circumstances. Factors like lifetime low wages, housing type checks, household income review, and age criteria all come into play together. This multi-layered approach explains why some applicants are surprised by rejections even after retirement. The goal is fairness, ensuring payouts go to those with limited retirement resources, rather than those who may appear cash-poor temporarily but had stronger CPF accumulation over time.

Why CPF contribution history affects Silver Support approval

CPF records provide a long-term picture of how much a person earned and saved throughout their career. For Silver Support, this history helps authorities identify seniors with genuinely limited means. Elements such as past CPF balances, employment duration, average monthly income, and work consistency are assessed together. A senior who had stable earnings for many years may not qualify, even if current income is low. While this can feel discouraging, it reflects a policy choice to prioritise those who faced sustained financial disadvantage across their working life.

Understanding income rules that lead to Silver Support rejections

Income rules can be another source of confusion for seniors and caregivers. The scheme reviews both personal and household income to ensure assistance targets the right groups. Considerations include household means test, property ownership limits, living arrangements, and support from family. Even small additional income sources or co-living with higher-earning family members can affect eligibility. Knowing these rules early helps families plan realistically and reduces disappointment when outcomes do not match expectations.

Making sense of Silver Support decisions in 2026

By combining CPF history and income checks, Silver Support decisions aim to balance compassion with sustainability. While rejections can feel personal, they are based on structured assessments rather than arbitrary judgment. Understanding policy intent clarity, transparent assessment logic, targeted senior aid, and long-term fairness can help seniors view outcomes more objectively. For those who do not qualify, exploring other assistance schemes may still provide meaningful support in retirement.

| Eligibility Factor | What Is Assessed | Why It Matters |

|---|---|---|

| Age | 65 years and above | Targets retirement-age seniors |

| CPF History | Long-term contributions | Reflects lifetime earnings |

| Income Level | Personal and household income | Ensures aid goes to lower-income seniors |

| Housing Type | HDB flat size | Indicates overall wealth level |

Frequently Asked Questions (FAQs)

1. Why was my Silver Support application rejected?

Rejections usually occur due to CPF history or income levels exceeding scheme thresholds.

2. Does low current income guarantee eligibility?

No, long-term CPF contribution history is also a key factor.

3. Can housing type affect Silver Support approval?

Yes, larger or higher-value housing can influence eligibility assessments.

4. Are there other schemes if I do not qualify?

Yes, seniors may explore other Singapore assistance programmes for support.