Singapore residents often face confusion when comparing financial support options, especially as the government rolls out new initiatives in 2026. The Assurance Package and Cost of Living Support are two key programs designed to ease everyday expenses, but their differences can be unclear. Understanding eligibility, payout schedules, and the scope of benefits is crucial for families and individuals alike. This guide breaks down both schemes in a clear, conversational way, helping Singaporeans make informed decisions and avoid payment comparison confusion, ensuring they receive maximum financial relief in the coming year.

Understanding the Assurance Package in 2026

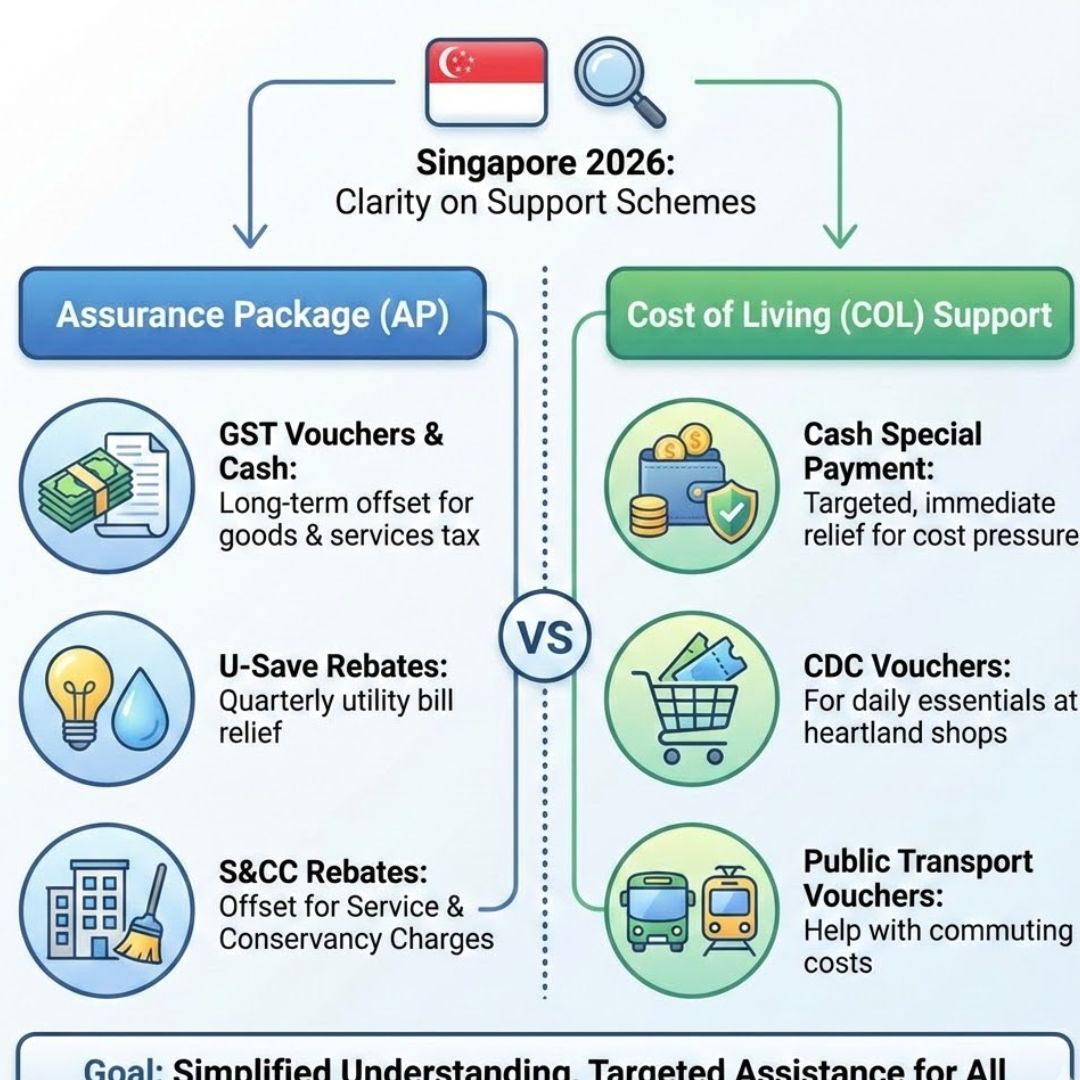

The Assurance Package benefits are aimed at providing targeted support to vulnerable groups, including seniors and low-income families. Payments are designed to cover essential needs like daily household expenses and utility bills assistance. The program also focuses on healthcare cost relief, helping recipients manage medical expenses without financial strain. With clear eligibility criteria and structured payout schedules, Singaporeans can plan their budgets more effectively. Unlike other schemes, the Assurance Package is directly deposited monthly, reducing administrative hurdles and ensuring timely support for households that need it most.

Breaking Down Cost of Living Support

Cost of Living Support provides broader financial assistance to all qualifying citizens, helping them navigate rising living expenses pressures in Singapore. It typically covers areas like groceries and essential items and supplements existing welfare programs. Payments are structured to be easy to access, with clear communication from government portals and SMS notifications. Unlike the Assurance Package, this support aims to offer general household relief rather than targeting specific groups. Understanding both schemes allows residents to optimize their monthly budget planning and ensure they receive the right mix of assistance without missing key benefits.

Comparing Assurance Package vs Cost of Living Support

Many Singaporeans wonder how the Assurance Package stacks up against Cost of Living Support. The main differences lie in eligibility and payout amounts, as well as the focus on targeted versus general relief. Assurance Package often gives higher assistance to specific groups like seniors, while Cost of Living Support offers smaller, consistent payments to a broader population. Payment timing and delivery methods can also differ, with some schemes offering quarterly vs monthly payments. Knowing these nuances allows households to maximize their financial support and reduces confusion when comparing payments across programs.

Summary and Key Takeaways

In summary, Singapore’s 2026 support schemes are designed to meet different needs. The Assurance Package focus is on targeted relief for vulnerable groups, whereas Cost of Living Support provides general household assistance. By understanding eligibility criteria, payout schedules, and covered expenses, residents can optimize their benefits. Clear comparison helps families avoid financial stress pitfalls and ensures every dollar of government support is effectively used. Staying informed about both programs empowers citizens to plan ahead and manage rising cost pressures efficiently.

| Program | Eligibility | Payment Frequency | Coverage |

|---|---|---|---|

| Assurance Package | Seniors, low-income households | Monthly | Utilities, healthcare, essential needs |

| Cost of Living Support | All qualifying citizens | Quarterly | Groceries, daily expenses |

| Combined Support Example | Seniors eligible for both | Monthly + Quarterly | Broad household and targeted relief |

Frequently Asked Questions (FAQs)

1. What is the eligibility for Assurance Package?

Seniors and low-income households meeting government criteria are eligible.

2. How often is Cost of Living Support paid?

It is typically disbursed on a quarterly basis to qualifying citizens.

3. Can someone receive both packages?

Yes, seniors or eligible households may receive combined support from both programs.

4. What expenses do these programs cover?

They help with essentials like utilities, groceries, healthcare, and daily expenses.