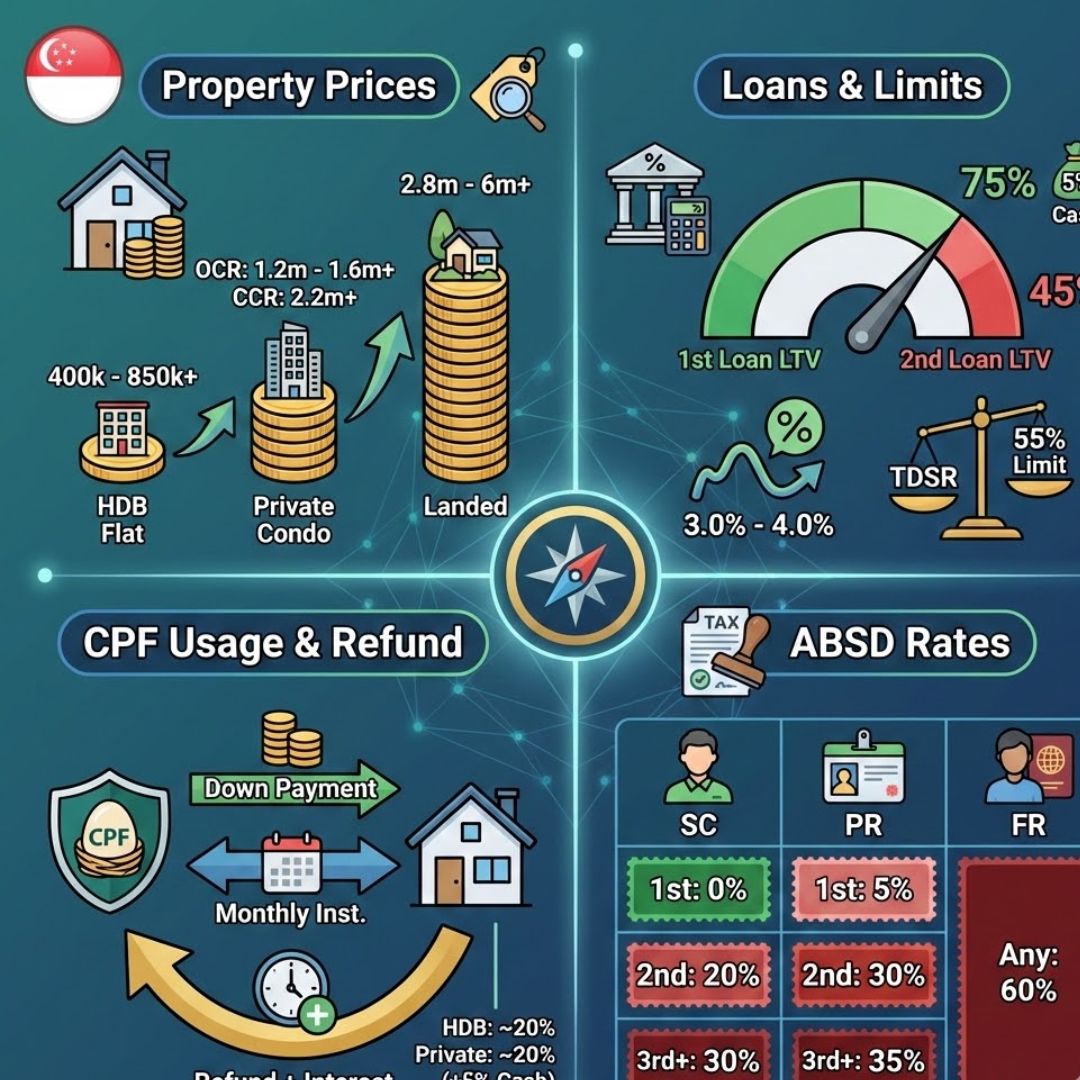

Singapore has unveiled its comprehensive 2026 guide for property buyers, aiming to simplify decisions around prices, loans, CPF usage, and ABSD. With the real estate market evolving rapidly, understanding latest price trends and loan eligibility rules is essential for both first-time buyers and seasoned investors. This new guide clarifies complex procedures, highlights CPF withdrawal limits, and explains ABSD rates, helping individuals make informed choices. Whether you’re planning to buy a HDB flat or a private condo, the 2026 updates provide clear insights into affordability, financing, and government regulations affecting property purchases in Singapore.

2026 Property Prices and Market Trends in Singapore

The 2026 guide breaks down median property prices across districts, showing where values have risen or softened. Buyers can now easily compare resale flat rates and private condo costs to determine affordability. Experts note that demand-supply balance and interest rate changes heavily influence market shifts, making timing crucial for investors. The report also highlights emerging neighborhoods offering better value, helping individuals plan purchases strategically. With clear data on price per square foot and market trends, buyers gain actionable insights into the Singapore real estate landscape and avoid costly guesswork.

Loan Eligibility and Financing Options for 2026 Buyers

Understanding HDB and bank loans is now simpler with the new guide. It details loan-to-value limits, income ceilings, and interest rate benchmarks for both first-timers and repeat buyers. For those relying on CPF, the guide explains withdrawal limits and conditions for using funds in property payments. Knowing these financing rules can prevent loan rejections and unexpected costs. Additionally, the guide outlines mortgage tenure options and eligibility for government grants, ensuring buyers can secure loans that suit their financial situation while maximizing affordability in Singapore’s competitive property market.

ABSD Rules and CPF Usage in 2026

The 2026 guide also clarifies ABSD rates for singles, couples, and investors, helping buyers understand total costs. It explains scenarios where CPF savings can offset cash payments and how property ownership limits impact additional taxes. Buyers are advised to review exemption criteria and payment deadlines to avoid penalties. The guide provides examples showing how combining CPF funds and cash can reduce upfront ABSD payments, making property acquisition smoother. Overall, it equips individuals with the knowledge to plan purchases strategically, optimize financing, and comply fully with Singapore’s property regulations.

Summary and Analysis

Singapore’s 2026 property guide is a game-changer for buyers, offering transparent pricing data and loan guidance that reduces guesswork. With insights into ABSD obligations and CPF usage limits, individuals can plan smarter purchases while avoiding common pitfalls. The guide also highlights market trends and financing strategies, enabling both first-time buyers and investors to make confident decisions. Ultimately, it consolidates essential information into a single reference, ensuring property decisions in Singapore are informed, efficient, and financially sound.

| Category | 2026 Details |

|---|---|

| HDB Loan-to-Value | Up to 90% for first-timers |

| Private Property ABSD | 10%-25% depending on ownership |

| CPF Withdrawal Limit | Based on valuation and outstanding loan |

| Median Condo Prices | $1.5M-$2.5M depending on district |

| Government Grants | $30,000-$50,000 for eligible buyers |

Frequently Asked Questions (FAQs)

1. What is the ABSD rate for first-time buyers?

It ranges from 0% to 10% depending on property type.

2. Can CPF funds be used for private condos?

Yes, up to the withdrawal limit based on valuation.

3. Are there government grants for HDB flats?

Eligible buyers can receive grants between $30,000 and $50,000.

4. How long can mortgage tenure be?

Bank loans typically allow up to 35 years tenure.