As Singapore prepares for 2026, many residents are trying to clearly understand the difference between the Assurance Package and Cost of Living payments. Both schemes are designed to cushion households against rising expenses, but overlapping timelines and purposes often create confusion. This guide breaks down how each support measure works, who benefits most, and why both exist side by side. By understanding these payouts early, Singaporeans can better plan monthly budgets, anticipate incoming support, and avoid misunderstandings about eligibility or payment expectations.

Understanding Singapore’s Assurance Package Support for 2026

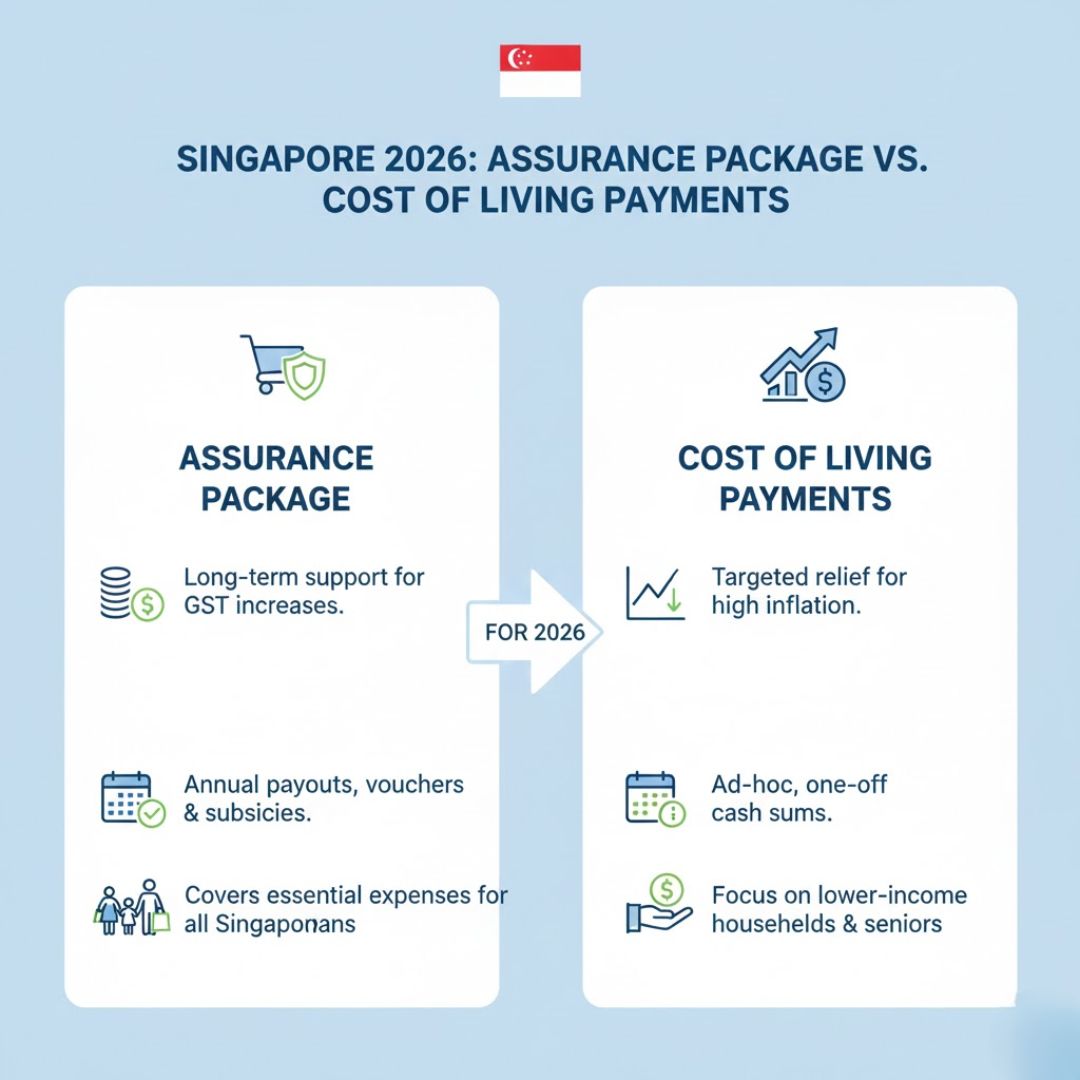

The Assurance Package in Singapore is a long-term support plan aimed at easing the impact of structural cost increases such as GST adjustments. Rather than acting as emergency relief, it focuses on sustained assistance spread over several years. Eligible households may receive cash payouts, utility rebates, and MediSave top-ups, depending on income and property ownership. The key idea is long-term stability, ensuring residents feel supported as policies evolve. For many families, this provides predictable relief planning and encourages financial confidence. Unlike short-term aid, the Assurance Package emphasizes policy transition support, helping citizens adjust gradually without sudden financial shocks.

How Cost of Living Payments Help Households Manage Daily Expenses

Cost of Living payments are more immediate in nature, designed to respond quickly to inflationary pressure felt in everyday spending. These payouts typically arrive as direct cash or vouchers and are timed to help with essentials like food, transport, and utilities. In 2026, such payments aim to address daily price pressure and provide immediate household relief. Many recipients see this as short-term cash help that complements other schemes. The flexibility of these payments allows families to prioritise urgent needs, offering spending flexibility during periods when living costs feel especially tight.

Goodbye to Dining Cost Worries as Singapore Households Receive S$150 Hawker and CDC Vouchers in 2026

Goodbye to Dining Cost Worries as Singapore Households Receive S$150 Hawker and CDC Vouchers in 2026

Key Differences Between Assurance Package and Cost of Living Aid

While both schemes support Singaporeans, their objectives and structures differ clearly. The Assurance Package focuses on strategic, multi-year assistance, whereas Cost of Living aid targets near-term challenges. Understanding this distinction reduces benefit overlap confusion and sets clear payout expectations. Assurance support is often means-tested with structured components, while Cost of Living payments may reach a broader group during specific periods. Together, they form complementary support layers that strengthen social resilience. Knowing which scheme applies helps households achieve better financial planning without assuming one replaces the other.

Why Both Schemes Matter for Singapore in 2026

Having both the Assurance Package and Cost of Living payments reflects Singapore’s balanced approach to social support. One addresses long-term policy shifts, while the other responds to immediate economic conditions. This dual system promotes economic resilience and ensures inclusive assistance coverage across different income groups. For residents, clarity about each scheme builds public trust and encourages proactive budgeting. In 2026, understanding how these measures work together will help households feel more secure and confident, knowing support is available both now and in the years ahead.

| Feature | Assurance Package | Cost of Living Payments |

|---|---|---|

| Main Purpose | Long-term GST offset | Short-term inflation relief |

| Payment Style | Cash, rebates, top-ups | Cash or vouchers |

| Duration | Multi-year | Periodic |

| Target Group | Means-tested households | Broad resident groups |

| 2026 Focus | Policy adjustment support | Rising daily costs |

Frequently Asked Questions (FAQs)

1. Are the Assurance Package and Cost of Living payments the same?

No, they serve different purposes and operate on different timelines.

2. Can a household receive both types of payments?

Yes, eligible households may receive support from both schemes.

3. Are Cost of Living payments permanent?

No, they are typically issued periodically based on economic conditions.

4. Do I need to apply separately for these schemes?

Most payments are automatically credited if eligibility criteria are met.