The Majulah Retirement Savings Bonus (RSB) serves this exact purpose. It provides a one-time CPF top-up designed to support seniors who fell behind on savings due to circumstances beyond their control. This includes stay-at-home parents and caregivers along with people who worked in lower-wage positions for many years. The Government uses this approach to address the savings gap in a subtle yet significant way.

What Is the Retirement Savings Bonus (RSB)?

The Retirement Savings Bonus (RSB) is a one-time CPF top-up, not a cash payout you can withdraw.

Its main goal is to help seniors who have not yet reached the Basic Retirement Sum (BRS) strengthen their CPF savings so they can receive better CPF LIFE monthly payouts in the future.

By adding money into your CPF earlier, you earn more interest over time — which translates into higher monthly income after age 65.

No application. No paperwork. No stress.

Majulah Retirement Savings Bonus 2026: Quick Overview

| Category | Information |

|---|---|

| One-Time Bonus Value | S$1,000 or S$1,500 credited once only |

| Eligible Group | Senior citizens whose CPF savings are below the Basic Retirement Sum |

| CPF Reference Limit | S$102,900 based on the 2024 Basic Retirement Sum threshold |

| Expected Credit Period | March 2026 for the majority of eligible seniors |

| Application Requirement | No application required — payment is processed automatically |

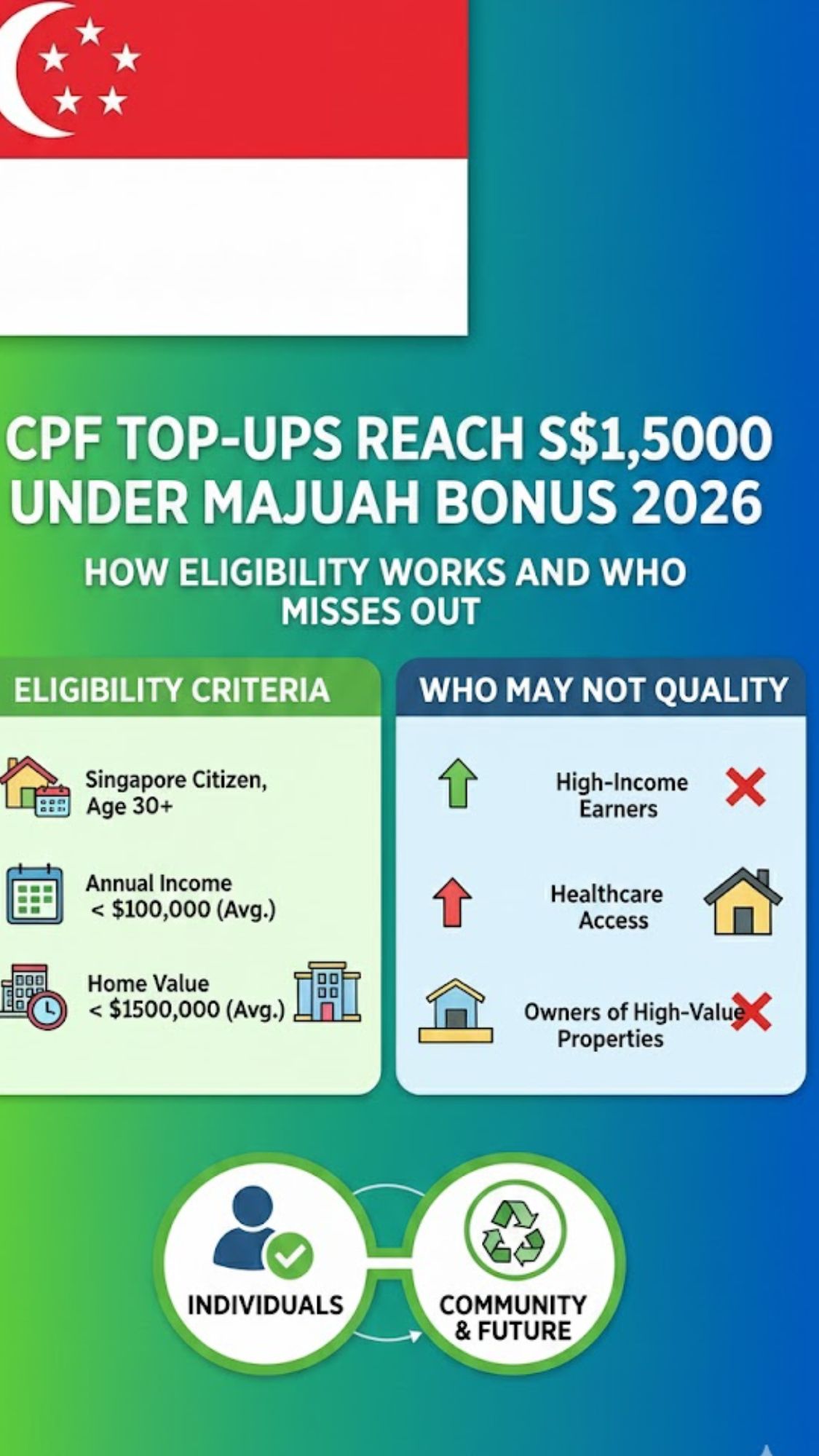

Who Is Eligible?

Eligibility is determined by your age, CPF retirement savings, and housing value — not your work status.

You qualify if you meet all of the following conditions:

– Singapore Citizen

– Born on or before 31 December 1973

(51 years old and above in 2024)

– Total CPF retirement savings below S$102,900

(Special Account + Retirement Account)

– Living in a property with an Annual Value (AV) of S$25,000 or below

– Own no more than one property

– For most HDB households, the AV requirement is usually not an issue.

How Much Will You Receive?

The bonus is paid in two different tiers, depending on how much CPF savings you currently have.

Once your savings reach the Basic Retirement Sum (BRS), the bonus stops — as it is designed purely to help lower-balance seniors catch up.

When Will the Bonus Be Credited?

Most eligible seniors are expected to receive the CPF top-up around January 2026

The account credited depends on your age:

– Age 55 and above → Retirement Account (RA)

– Age 51 to 54 → Special Account (SA)

The CPF Board will handle everything automatically.

No application required. No follow-up needed.

| CPF Retirement Savings (SA + RA) | One-Time Retirement Bonus |

|---|---|

| Less than S$60,000 | S$1,500 |

| S$60,000 to S$102,900 | S$1,000 |

Why This Bonus Is More Powerful Than It Looks

S$1,500 may seem modest at first.

But inside CPF, it behaves very differently:

– High interest: RA and SA earn between 4% and 6% risk-free

– Compounding growth: Earlier top-ups grow more over time

– Lifetime benefit: Higher RA balances increase CPF LIFE payouts

– Zero investment risk: Not affected by market fluctuations

For seniors with lower CPF balances, this quiet top-up can make a meaningful long-term difference.

What You Should Do Now

There is very little action required from you.

– Log in to your CPF account using Singpass to check your balances

– If you live in private housing, verify your property’s Annual Value on IRAS

– Look out for an official SMS from gov.sg or a LifeSG notification in early 2025

After that — simply wait.