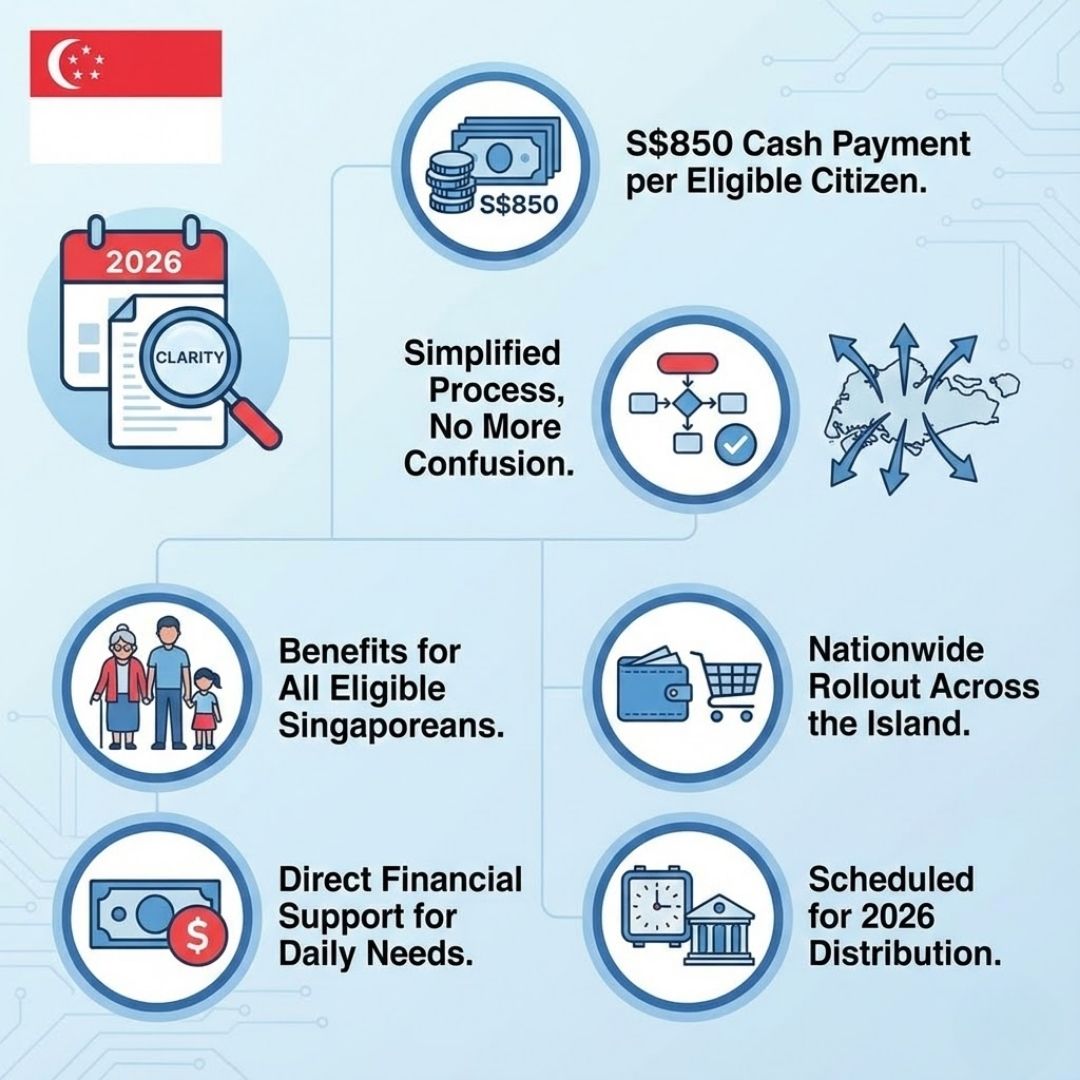

Singapore residents are set to welcome greater clarity in 2026 as the government rolls out S$850 GST Voucher payments under an updated support framework. Designed to ease cost-of-living pressures, this move simplifies eligibility, timelines, and payout expectations that previously caused confusion. By streamlining communication and payment processes, Singapore aims to ensure households clearly understand what they are entitled to receive. The refreshed GST Voucher approach reflects a broader national effort to provide targeted relief while maintaining transparency, predictability, and fairness for citizens navigating rising everyday expenses.

GST Voucher Payments Bring Clarity in Singapore

The 2026 rollout marks a turning point for GST support, with clearer guidelines and smoother delivery for eligible Singaporeans. Instead of fragmented updates, residents now benefit from clear payout structure, improved notifications, and automatic disbursement to registered accounts. Authorities emphasize simplified eligibility checks, reducing uncertainty for seniors and low-income households. With better alignment across agencies, the system ensures timely financial relief without complex applications. Many families also appreciate the focus on predictable yearly support, helping them plan budgets more confidently as living costs evolve across the city-state.

S$850 GST Support Helps Households Manage Costs

The enhanced S$850 GST Voucher is designed to offset daily expenses such as utilities, groceries, and transport. Policymakers highlight direct cash assistance as a flexible way to meet diverse household needs. By focusing on middle and lower incomes, the scheme strengthens social equity while remaining fiscally responsible. Residents can expect automatic bank credits, minimizing delays and administrative stress. Importantly, the payment supports cost-of-living stability, giving families reassurance that government aid keeps pace with economic realities in Singapore.

Singapore GST Voucher System Updated for 2026

Beyond the payment amount, the 2026 changes modernize how GST Vouchers are managed. Digital integration allows for faster payment processing and clearer communication through official channels. The government has also reinforced data accuracy checks to ensure the right recipients are paid correctly. Residents benefit from reduced administrative confusion, as fewer manual steps are required. Overall, these updates promote greater public trust in how social support schemes are delivered nationwide.

Understanding the Impact of the 2026 GST Voucher Changes

The S$850 GST Voucher rollout reflects Singapore’s broader strategy of proactive social support. By addressing past uncertainties, the government demonstrates a commitment to transparent policy delivery and responsiveness to citizen feedback. The updated framework balances efficiency with inclusivity, ensuring assistance reaches those who need it most. As economic conditions shift, such measures provide long-term household reassurance while reinforcing fiscal discipline. For many residents, the 2026 changes represent not just financial help, but renewed confidence in public support systems.

| Category | Details | Notes |

|---|---|---|

| Payment Amount | S$850 | Total annual support |

| Eligible Group | Lower- and middle-income citizens | Based on income and property |

| Payment Method | Direct bank credit | No application needed |

| Expected Timeline | Throughout 2026 | Phased disbursement |

| Purpose | Cost-of-living relief | Flexible household use |

Frequently Asked Questions (FAQs)

1. Who qualifies for the S$850 GST Voucher?

Eligible Singapore citizens are assessed based on income level and property ownership.

2. Do I need to apply for the 2026 GST Voucher?

No application is required if your bank details are already registered.

3. When will the GST Voucher be paid?

Payments will be disbursed in phases across 2026.

4. How will I receive the payment?

The voucher will be credited directly to your linked bank account.