Singapore has taken a clearer stance on retirement support, easing long-standing confusion around who truly benefits from the Silver Support Scheme. As living costs rise and seniors reassess their financial security, many have questioned whether this payout genuinely reaches those who need it most. Recent clarifications from authorities now explain eligibility, payment structure, and how the scheme fits alongside CPF savings. For older Singaporeans planning their later years, understanding these details is essential to avoid misunderstandings and make informed retirement decisions.

Silver Support Scheme eligibility finally explained

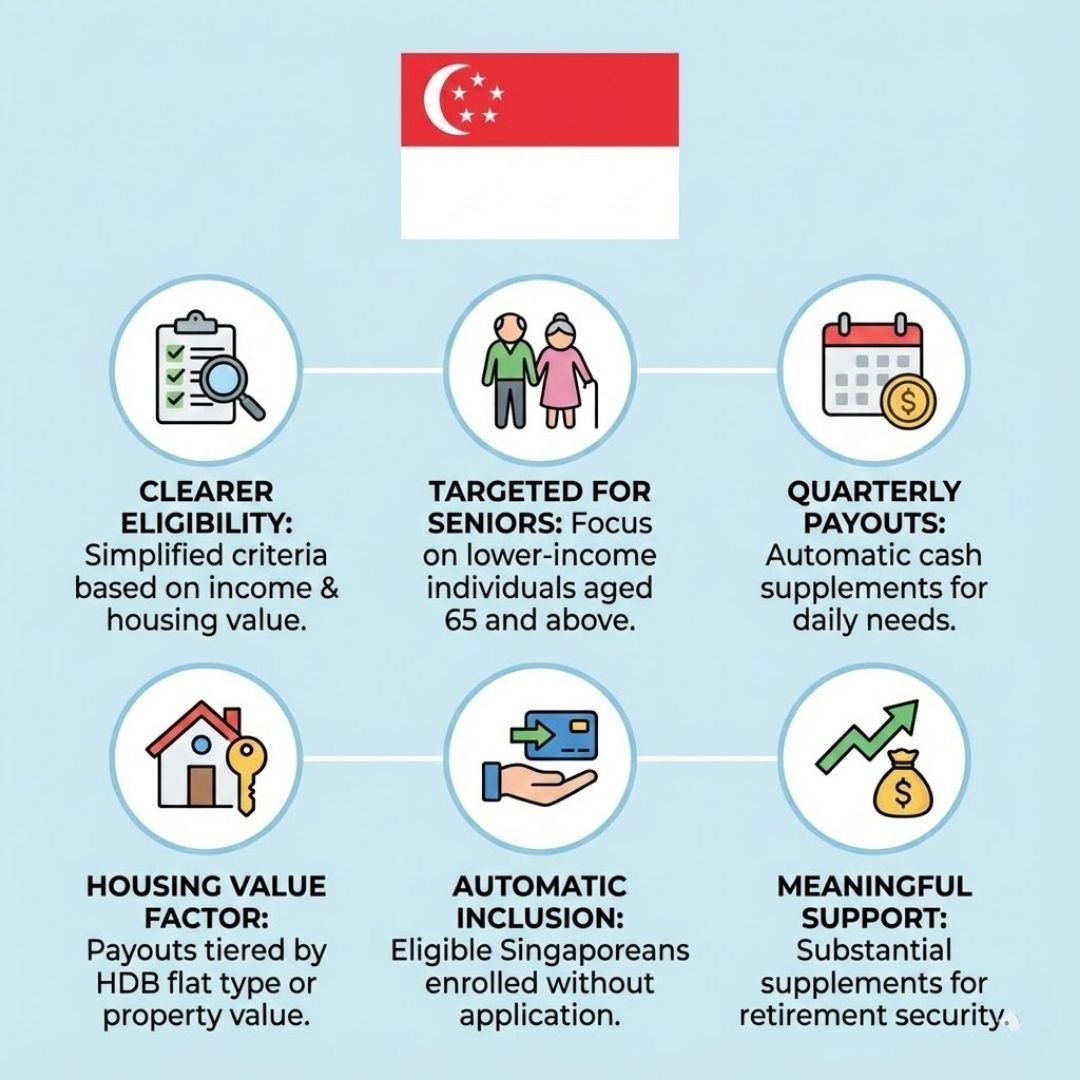

One major source of confusion has been who actually qualifies for Silver Support. The scheme is designed for seniors with low lifetime earnings and limited family support, not as a universal retirement payout. Authorities assess factors like CPF contributions, housing type, and household income to determine eligibility. This means seniors who own smaller HDB flats and had modest wages are more likely to benefit. The goal is to provide targeted retirement help rather than broad assistance, ensuring funds go to those with lower lifetime incomes. By focusing on means-tested criteria, the government aims to strengthen social safety nets while maintaining fairness across generations.

How Silver Support benefits Singapore retirees

For eligible seniors, Silver Support offers quarterly cash payouts that supplement CPF LIFE or other retirement income. While the amounts may not cover all expenses, they help offset daily costs like utilities and groceries. This additional support can make a meaningful difference for those without strong family backing. Importantly, the payouts are automatic, reducing paperwork stress for older citizens. By acting as a steady income boost, the scheme supports basic living needs and reduces anxiety over retirement cash flow. Many beneficiaries view it as a practical layer of financial stability support rather than a complete solution.

Goodbye to Cost of Living Relief Doubts as Seniors Question Whether Silver Support Is Enough in 2026

Goodbye to Cost of Living Relief Doubts as Seniors Question Whether Silver Support Is Enough in 2026

Why Singapore clarified Silver Support rules now

The clarification comes as more seniors actively plan retirement amid rising longevity and healthcare costs. Misunderstandings had led some to expect benefits they were never meant to receive, causing frustration. Clearer communication helps manage expectations and encourages realistic planning using CPF, savings, and community support. It also reinforces trust in public schemes by showing how decisions are made. By addressing retirement planning confusion, the government aims to promote informed senior choices and highlight long-term policy intent. This transparency supports public confidence growth in Singapore’s retirement framework.

Understanding the real impact of Silver Support

Ultimately, Silver Support is not about equal payouts but equitable outcomes. It recognises that not all seniors start retirement from the same financial position. When combined with CPF LIFE, healthcare subsidies, and community aid, it forms part of a broader support ecosystem. Seniors who understand this can plan more effectively and avoid disappointment. The scheme’s strength lies in its focus on income gap reduction and targeted senior aid, rather than universal benefits. With clearer rules, Singapore reinforces a balanced retirement system that prioritises sustainability and fair resource allocation.

| Category | Details | Frequency |

|---|---|---|

| Eligible Age | 65 years and above | Ongoing |

| Housing Criteria | 1–3 room HDB flats | Reviewed periodically |

| Income Basis | Low lifetime CPF contributions | Assessed annually |

| Payout Method | Automatic cash transfer | Quarterly |

Frequently Asked Questions (FAQs)

1. Who qualifies for the Silver Support Scheme?

Seniors aged 65 and above with low lifetime incomes and limited household support may qualify.

Goodbye to Confusion Over GST Vouchers as S$850 Payments Roll Out Across Singapore in 2026

Goodbye to Confusion Over GST Vouchers as S$850 Payments Roll Out Across Singapore in 2026

2. Is Silver Support given every month?

No, payments are typically made on a quarterly basis.

3. Do I need to apply for Silver Support?

No application is required as eligible seniors are assessed automatically.

4. Can Silver Support replace CPF LIFE payouts?

No, it is meant to supplement CPF LIFE, not replace it.