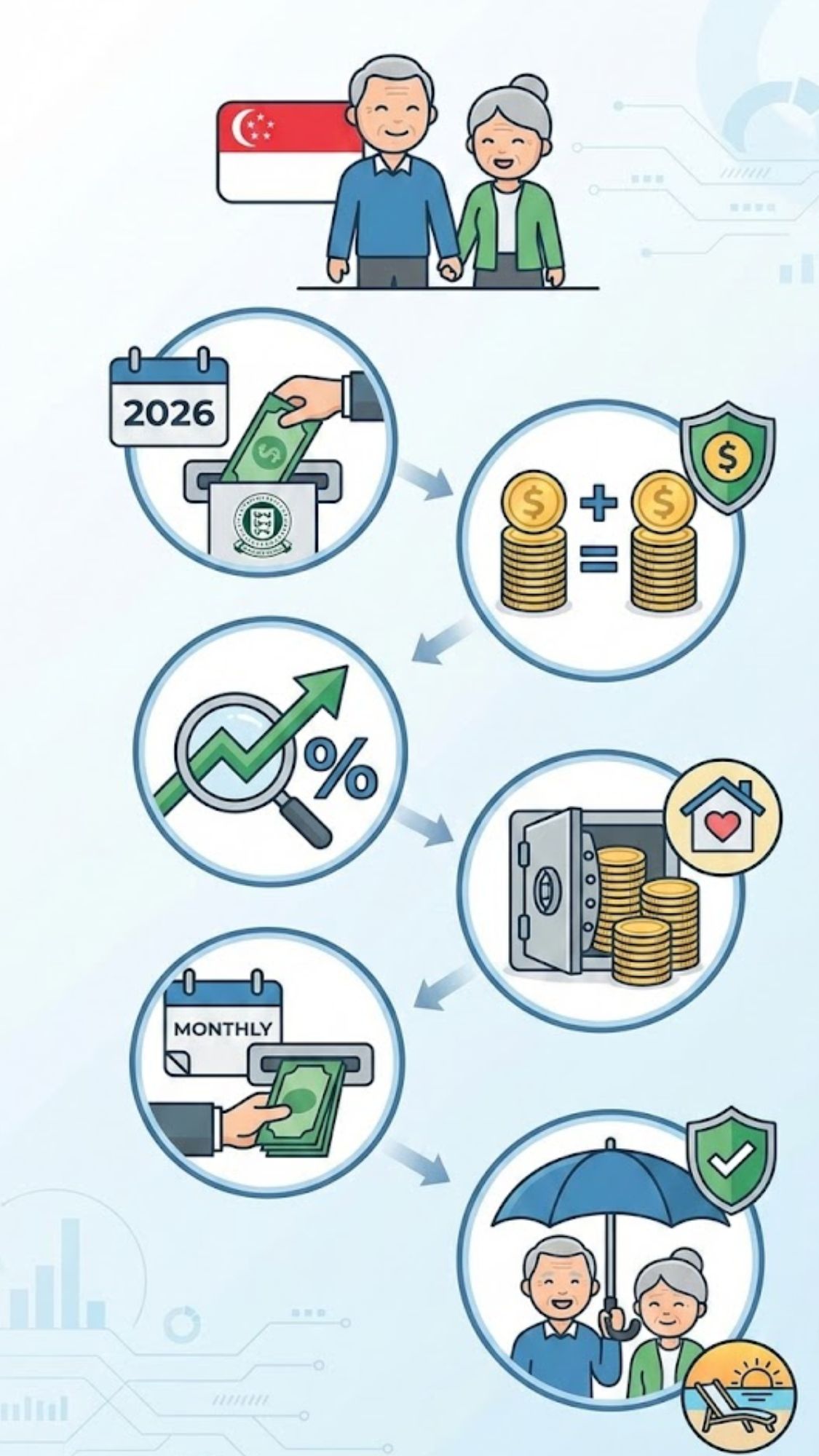

Senior couples in Singapore are set to receive meaningful financial relief in 2026 through an extra CPF bonus aimed at strengthening retirement security. As living costs rise and healthcare needs increase with age, this targeted support recognises the shared financial responsibilities many older couples face. The additional payout is designed to supplement existing CPF savings, helping households better manage daily expenses and long-term planning. For many Singaporean seniors, this move reflects a broader effort to ensure ageing couples can enjoy stability, dignity, and peace of mind during their retirement years.

How the Singapore CPF bonus supports senior couples

The CPF bonus for senior couples is structured to reward shared retirement planning and mutual support. Eligible couples can receive an additional $2,000 credited into their CPF accounts, easing pressure on monthly budgets and medical costs. This initiative highlights retirement income security, reinforces joint household planning, and encourages long-term savings habits among older residents. By focusing on couples rather than individuals, the scheme recognises shared financial needs and promotes stable ageing households. For many, this bonus complements existing payouts like CPF Life, creating a more predictable and reliable income stream in later years.

Eligibility rules for the 2026 CPF bonus in Singapore

Eligibility for the 2026 CPF bonus depends on several clear conditions set by Singapore authorities. Generally, both partners must meet age requirements and hold CPF accounts in good standing. Household income thresholds and housing type may also be considered to ensure support reaches those who need it most. The policy prioritises lower-income retirees, supports ageing married couples, and maintains fair distribution rules. By applying means-tested criteria and transparent assessment checks, the system aims to balance inclusivity with sustainability, ensuring public funds are directed responsibly.

Goodbye to Unused SG60 Benefits as Singaporeans Learn How to Claim and Spend S$600 to S$800 Vouchers

Goodbye to Unused SG60 Benefits as Singaporeans Learn How to Claim and Spend S$600 to S$800 Vouchers

Why the CPF bonus matters for senior households

For senior households, even a modest additional payout can have a noticeable impact on daily life. The $2,000 CPF bonus can help cover utilities, healthcare co-payments, or emergency needs without dipping into core savings. This support strengthens monthly cash flow, reduces retirement stress levels, and enhances financial resilience. It also reinforces confidence in CPF as a lifelong support system and encourages active retirement planning. Over time, such measures contribute to a more secure and inclusive ageing society in Singapore.

Summary and outlook for 2026

Looking ahead to 2026, the extra CPF bonus for senior couples signals a continued commitment to supporting Singapore’s ageing population. By recognising couples as economic units, policymakers address real-world household dynamics and costs. The measure promotes sustainable retirement support, aligns with ageing population goals, and reflects pro-family policies. As longevity increases, such targeted assistance can play a vital role in maintaining quality later life and ensuring financial peace for older couples navigating retirement together.

| Category | Details |

|---|---|

| Bonus Amount | $2,000 per eligible senior couple |

| Target Group | Married senior couples in Singapore |

| Payment Year | 2026 |

| Key Criteria | Age, CPF status, household income |

| Purpose | Enhance retirement financial security |

Frequently Asked Questions (FAQs)

1. Who qualifies for the CPF bonus?

Eligible married senior couples meeting age and income criteria can receive it.

2. Is the $2,000 paid in cash?

No, it is credited directly into eligible CPF accounts.

3. When will the bonus be given?

The CPF bonus is scheduled to be credited sometime in 2026.

4. Does this affect other CPF payouts?

No, it is an additional bonus and does not reduce existing benefits.